Guided Wealth Management - Truths

Guided Wealth Management - Truths

Blog Article

All About Guided Wealth Management

Table of ContentsFascination About Guided Wealth ManagementThe Guided Wealth Management IdeasA Biased View of Guided Wealth ManagementNot known Facts About Guided Wealth ManagementSome Known Details About Guided Wealth Management

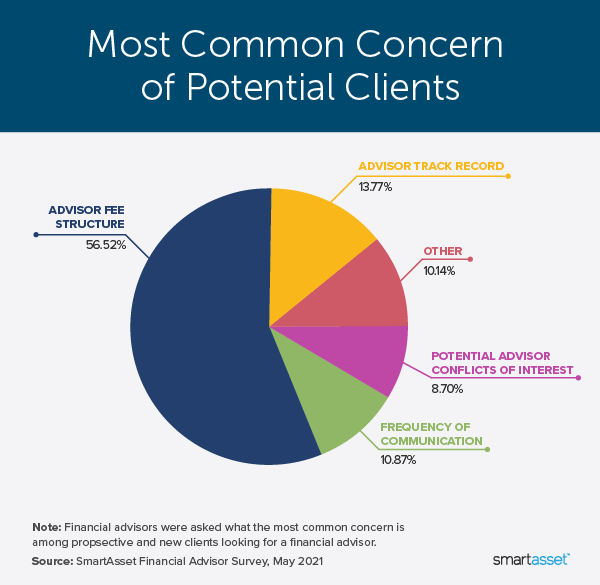

Be alert for possible disputes of interest. The advisor will set up an asset allocation that fits both your danger resistance and risk capacity. Asset appropriation is simply a rubric to identify what percentage of your total monetary profile will certainly be distributed throughout different asset classes. A more risk-averse individual will certainly have a better concentration of federal government bonds, deposit slips (CDs), and money market holdings, while a person that is more comfortable with danger might decide to tackle more stocks, company bonds, and perhaps even financial investment realty.

The typical base wage of a monetary consultant, according to Certainly as of June 2024. Note this does not include an approximated $17,800 of yearly commission. Any person can work with a financial expert at any age and at any phase of life. financial advice brisbane. You do not need to have a high internet well worth; you just have to find an advisor matched to your scenario.

Not known Incorrect Statements About Guided Wealth Management

Financial advisors work for the client, not the firm that uses them. They should be receptive, eager to explain monetary ideas, and maintain the customer's best rate of interest at heart.

An expert can suggest feasible enhancements to your strategy that could assist you achieve your objectives better. If you do not have the time or passion to handle your funds, that's one more great factor to employ a financial expert. Those are some basic reasons you could require a consultant's professional help.

An excellent monetary advisor shouldn't simply offer their solutions, however provide you with the devices and sources to end up being financially smart and independent, so you can make enlightened decisions on your very own. You desire an expert that remains on top of the monetary extent and updates in any type of area and who can address your economic inquiries regarding a myriad of topics.

Excitement About Guided Wealth Management

Others, such as qualified financial coordinators(CFPs), already abided by this standard. Even under the DOL regulation, the fiduciary criterion would not have actually related to non-retirement advice. Under the suitability requirement, economic experts commonly service commission for the products they offer to customers. This means the client may never ever obtain a costs from the financial expert.

Some advisors may supply lower rates to assist clients who are just obtaining started with economic planning and can't manage a high monthly price. Typically, a financial consultant will offer a free, initial assessment.

A fee-based economic expert is not the very same as a fee-only economic consultant. A fee-based expert might make a charge for creating a financial plan for you, while likewise gaining a commission for marketing you a specific insurance coverage item or financial investment. A fee-only economic advisor makes no compensations. The Stocks and Exchange Compensation (SEC) recommended its very own fiduciary rule called Law Best Passion in April 2018.

Our Guided Wealth Management Diaries

Robo-advisors don't require you to have much cash to get begun, and they cost less than human monetary consultants. A robo-advisor can not talk with you concerning the ideal way to get out of financial obligation or fund your youngster's education and learning.

An advisor can help you figure out your cost savings, just how to build for retirement, help with estate preparation, and others. Financial advisors can be paid in a number of means.

Guided Wealth Management - Truths

Along with the usually tough emotional ups and downs of separation, both partners will certainly have to deal with essential financial considerations. You may really well need to change your monetary approach to keep your objectives on track, Lawrence states.

An abrupt increase of cash or possessions elevates immediate inquiries concerning what to do with it. "A monetary expert can aid you analyze the methods you could place that cash to pursue your individual and economic goals," Lawrence states. You'll want to consider just how much could most likely to paying for existing financial debt and just how much you might take into consideration spending to pursue a more safe and secure future.

Report this page